Tax Reform

Candidates' views>>

Background

|

|

|

|

|

Issues |

|

Abortion

|

|

Budget & Economy

|

|

Civil Rights

|

|

Corporations

|

|

Crime

|

|

Drugs

|

|

Education

|

|

Energy & Oil

|

|

Environment

|

|

Families & Children

|

|

Foreign Policy

|

|

Free Trade

|

|

Government Reform

|

|

Gun Control

|

|

Health Care

|

|

Homeland_Security

|

|

Immigration

|

|

Infrastructure & Technology

|

|

Jobs

|

|

Principles & Values

|

|

Social Security

|

|

Tax Reform

|

|

War & Peace

|

|

Welfare & Poverty

|

Error processing SSI file

|

|

Archives|

|

FactCheck.org analysis of 2008 primary debates

Florida Senate candidates, past and present

Going Rogue, by Sarah Palin

ABC This Week interviews, throughout 2020

FactCheck.org analysis of 2008 campaign ads

Analysis of 2001-2009 campaign ads

IA newspaper: The Des Moines Register

CNN "State of the Union" interviews, throughout 2020

A Senator Speaks Out, by Rick Santorum (June 8, 2005)

Outsider in the House, by Senator Bernie Sanders (I, VT)

Our Revolution, by Bernie Sanders

Vox Media

The Nation magazine

AK newspaper: Anchorage Daily News

From Hope to Higher Ground, by Gov. Mike Huckabee

The America We Deserve, by Donald Trump

Survey of 2009 and 2010 Senate campaign websites

FactCheck.org analysis of 2007 primary debates

Trump Research Book

The Tea Party Goes to Washington, by Rand Paul (Feb. 22, 2011)

2010: Take Back America, by Dick Morris & Eileen McGann

Jeb: America's Next Bush, by S.V. Date

MA newspaper: The Boston Globe, 2000s

The Washington Times

Axios coverage of political news

Political coverage by the Associated Press

Georgia candidates for Governor, past and present

Time to Get Tough, by Donald Trump

FeelTheBern grassroots website

Do the Right Thing, by Mike Huckabee

The Art of the Comeback, by Donald J. Trump and Kate Bohner

An American Son, by Senator Marco Rubio

America the Beautiful, by Ben Carson

Against the Tide: How a Compliant Congress Empowered a Reckless President, by Lincoln Chafee

The 2015 Iowa Freedom Summit, Ag Summit, and other Iowa events

Survey of Gubernatorial campaign websites, 2010-2011

Survey of 2010 Governor`s campaign websites

Vast Right-Wing Conspiracy, by Amanda Carpenter

Unintimidated: A Governor's Story, by Wisconsin Governor Scott Walker

The Truths We Hold: An American Journey

Trump campaign vs. Trump administration compared

The Speech, by Bernie Sanders

It Takes a Family, by Rick Santorum (April 30, 2006)

It Takes A Village, by Hillary Clinton

Stand For Something, by John Kasich

Texas Senate candidates, past and present

Kentucky Senate candidates, past and present

California Senate candidates, past and present

Alaska Senate candidates, past and present

The Rise of Marco Rubio, by Manuel Roig-Franzia

Guide to Political Revolution

The Party's Over, by former Florida Governor Charlie Crist

This Fight Is Our Fight: The Battle to Save America's Middle Class, by Elizabeth Warren

One Nation, by Dr. Ben Carson, M.D.

Obamanomics, by John R. Talbott, published July 1, 2008

The Obama Nation, by Jerome Corsi

Obama's Challenge, by Robert Kuttner

Nine and Counting, by Catherine Whitney

Never Enough, by Michael D'Antonio (Sept. 2015)

USA Today magazine

Univision News

Time magazine

The Week magazine

The Economist magazine

Snopes.com fact-checking

Slate.com

Reason Magazine

NY newspaper: Wall Street Journal

The New York Times, 2010-2019

The New York Times, 2000-2009

The National Press Club

Political coverage in National Review

Mother Jones magazine

MI newspaper: The Detroit Free Press

Medium.com blog

MA newspaper: The Boston Globe

League of Women Voters

CNN Kfile

Human Events magazine

Political coverage on The Huffington Post

The Washington Post, 2000-2009

Catholic News Service

CNN political race coverage

The Atlantic magazine

Political coverage by the Associated Press

National Journal's Almanac of American Politics

Wisconsin state legislative records

Louisiana state legislative records

Florida state legislative records

Leadership and Crisis, by Bobby Jindal

Joint Libertarian interview with Johnson & Weld

Barack Obama: This Improbable Quest, by John K. Wilson

What Every American Should Know, by the American Conservative Union

Wisconsin candidates for Governor, past and present

Alaska candidates for Governor, past and present

The Land of Flickering Lights, by Michael Bennet

The Essential Bernie Sanders, by Jonathan Tasini (Oct. 2015)

Do Not Ask What Good We Do, by Robert Draper

The Debt Bomb, by Sen. Tom Coburn

Courage and Consequence, by Karl Rove

Character IS the Issue, by Mike Huckabee

Change We Can Believe In

The Audacity of Hope, by Barack Obama

American Dreams, by Senator Marco Rubio (R-FL)

Jeb Bush: Aggressive Conservatism in Florida, by Robert E. Crew

2020 Vice Presidential prospects

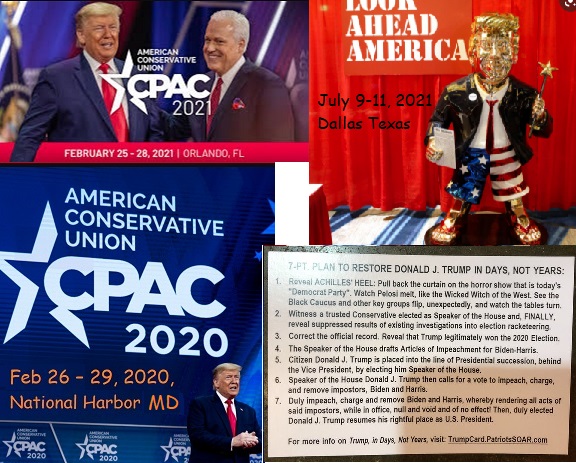

Speeches at CPAC 2020s

2019-2021 Town Halls on CNN

Speeches at Conservative Political Action Conferences (2016-2019)

CNN "State of the Union" interviews, throughout 2019

CampusElect 2018 candidate summary - Governors

CNN "State of the Union" interviews, throughout 2017

Survey of 2016 Senate campaign websites

2016 California Senate race

CBS 2015 Democratic primary debate

FactCheck.org analysis of 2009 political speeches

Washington Post, "The Fact Checker"

Survey of 2004 House campaign websites

12 Steps Forward, by Sen. Bernie Sanders

100 Innovative Ideas for Florida's Future, by Marco Rubio

(click a picture above for excerpts or other books and debates about Tax Reform)

|

|

|

Political Leaders |

Error processing SSI file

|

|

Site Map |

Home

(Main page) |

Issues

(Presidential quotations organized by topic) |

Candidates

(Presidential quotations organized by candidate) |

Recent

(Most recent quotation for each candidate) |

Issue Grid

(Summary by topic of each candidate's positions) |

Candidate Grid

(Summary by candidate of positions on each topic) |

Archives

(Debate and book excerpts) |

House of Representatives

(112th Congress) |

Senate

(112th Senate) |

Governors

(50 incumbents) |

Cabinet

(Present and Past Secretaries) |

Supreme Court

(Present and Past Justices) |

Mayors

(Big-City Mayors) |

Presidents

(Past Presidents) |

VoteMatch

(Presidential Selector and Political Affiliation 20-question quiz) |

About Us

(About OnTheIssues.org) |

Write Us

(Your feedback to us) |

| |

|

Stacey Abrams on Tax Reform

Stacey Abrams on Tax Reform

|

| Democratic Gubernatorial Challenger (GA); 2020 Veepstakes contender |

Click here for 2 full quotes by Stacey Abrams

OR click here for Stacey Abrams on other issues.

- Ask everyone to do their fair share. (May 2017)

- Keep graduated income tax instead of 5.4% flat tax. (Mar 2017)

|

Justin Amash on Tax Reform

Justin Amash on Tax Reform

|

| Independent MI Rep; possible Presidential Challenger |

Click here for 6 full quotes by Justin Amash

OR click here for Justin Amash on other issues.

- Leave tax rates low for everyone. (Nov 2010)

- Taxpayer Protection Pledge: no new taxes. (Aug 2010)

- Adopt a single-rate tax system. (Jul 2010)

- Repeal tax hikes in capital gains and death tax. (Jul 2010)

- Supports the Taxpayer Protection Pledge. (Jan 2012)

- Death Tax is a pernicious double tax. (Apr 2015)

|

Joe Biden on Tax Reform

Joe Biden on Tax Reform

|

| Former Vice President; previously Democratic Senator (DE) |

Click here for 40 full quotes by Joe Biden

OR click here for Joe Biden on other issues.

- End tax cuts for wealthy and corporations; not all tax cuts. (Oct 2020)

- Eliminate Trump tax cuts; invest in people who need help. (Sep 2020)

- Return top rate to 39.6% from 37%; cap itemized deductions. (Sep 2020)

- FactCheck: tax hike on top 1%, not on all American families. (Aug 2020)

- Raise taxes for anybody making over $400K, not mom & pop. (Aug 2020)

- Tax code shouldn't reward wealth more than work. (Aug 2020)

- Past time for wealthy & corporations to pay their fair share. (Aug 2020)

- Repeal high-income excess business losses tax cut. (Apr 2020)

- More tax breaks for Latino and black businesses. (Feb 2020)

- Undo 2017 tax cut, eliminate "stepped-up basis loophole". (Nov 2019)

- Millionaires pay more; middle class pays less. (Oct 2012)

- Not mathematically possible to cut $5T in loopholes. (Oct 2012)

- Tax revenue increases must be part of budget deal. (Apr 2012)

- Surtax on earnings over $1 million seems fair to us. (Nov 2011)

- Economic inequity worsened by tax cuts for the wealthy. (Apr 2010)

- Middle class is U.S. economic engine and needs tax cuts. (Oct 2008)

- Save $150 billion in tax cuts for people who donít need them. (Dec 2007)

- Take away $85B in annual tax cuts for 1% of top earners. (Jul 2007)

- FactCheck: Top 1% only got $67B in 2007 tax cuts, not $85B. (Jul 2007)

- Eliminate the tax cut just for those people in the top 1%. (Mar 2007)

Voting Record

- FactCheck: McCain did not vote with Obama on tax increase. (Oct 2008)

Wealth Tax

- Tax earnings over $400K, capital gains & estate tax. (Feb 2021)

- Voted YES on increasing tax rate for people earning over $1 million. (Mar 2008)

- Voted NO on allowing AMT reduction without budget offset. (Mar 2008)

- Voted NO on raising the Death Tax exemption to $5M from $1M. (Feb 2008)

- Voted NO on repealing the Alternative Minimum Tax. (Mar 2007)

- Voted NO on raising estate tax exemption to $5 million. (Mar 2007)

- Voted NO on supporting permanence of estate tax cuts. (Aug 2006)

- Voted NO on permanently repealing the `death tax`. (Jun 2006)

- Voted YES on $47B for military by repealing capital gains tax cut. (Feb 2006)

- Voted NO on retaining reduced taxes on capital gains & dividends. (Feb 2006)

- Voted NO on extending the tax cuts on capital gains and dividends. (Nov 2005)

- Voted NO on $350 billion in tax breaks over 11 years. (May 2003)

- Voted YES on reducing marriage penalty instead of cutting top tax rates. (May 2001)

- Voted YES on increasing tax deductions for college tuition. (May 2001)

- Voted YES on eliminating the 'marriage penalty'. (Jul 2000)

- Voted NO on across-the-board spending cut. (Oct 1999)

- Voted NO on requiring super-majority for raising taxes. (Apr 1998)

- Rated 15% by NTU, indicating a "Big Spender" on tax votes. (Dec 2003)

- Rated 100% by the CTJ, indicating support of progressive taxation. (Dec 2006)

|

Mike Bloomberg on Tax Reform

Mike Bloomberg on Tax Reform

|

| Mayor of New York City (Independent) |

Click here for 13 full quotes by Mike Bloomberg

OR click here for Mike Bloomberg on other issues.

- Raise taxes on the rich. (Feb 2020)

- 5% surtax on income above $5 million a year. (Jan 2020)

- Wealth tax is counterproductive and unconstitutional. (Jan 2019)

- Progressive tax yes; wealth tax no. (Jan 2019)

- The wealthy prefer the current rigged system. (Jan 2019)

- Wealth tax is unconstitutional & counterproductive. (Jan 2019)

- Tax cuts paying for themselves defies reality. (Dec 2017)

- GOP tax bill is an economically indefensible blunder. (Dec 2017)

- Raised property taxes to 18.5%, highest in history. (Sep 2010)

- 2004: Refunded $250M to residential taxpayers, not business. (Sep 2010)

- $400 property tax rebate to all homeowners. (Jan 2008)

- Raised taxes on high-earners to incent municipal employees. (Jun 2007)

- Raised property taxes 18% to pay off budget deficit. (Mar 2007)

|

Cory Booker on Tax Reform

Cory Booker on Tax Reform

|

| Mayor of Newark; N.J. Senator; 2020 presidential contender (withdrawn) |

Click here for 7 full quotes by Cory Booker

OR click here for Cory Booker on other issues.

- No wealth tax, but raise estate tax. (Nov 2019)

- Expand Earned Income Tax Credit. (May 2019)

- Helped people claim earned-income tax credit. (Apr 2019)

- Tax plan that rewards hard work. (Oct 2017)

- Promised no taxes; but meant "no on one city tax increase". (Apr 2017)

- Raise taxes because quick fix of cuts wasn't enough. (Jul 2011)

- One-time building sale, plus tax increase, to balance budget. (Feb 2010)

|

Pete Buttigieg on Tax Reform

Pete Buttigieg on Tax Reform

|

| Democratic Presidential Challenger; IN Mayor |

Click here for 5 full quotes by Pete Buttigieg

OR click here for Pete Buttigieg on other issues.

- Move from fuel taxes to mileage fees to fund roads. (Dec 2020)

- The American Dream [is collapsing except in] Denmark. (Feb 2020)

- April: raise top tax rate; October: "soft-pedals" wealth tax. (Nov 2019)

- Financial transactions tax, wealth tax, and estate tax. (Aug 2019)

- The wealthy should pay their fair share in taxes. (Apr 2019)

|

Julian Castro on Tax Reform

Julian Castro on Tax Reform

|

| Democratic Presidential Challenger (withdrawn); former HUD Secretary |

Click here for 5 full quotes by Julian Castro

OR click here for Julian Castro on other issues.

- Tax inherited windfalls as ordinary income. (Nov 2019)

- Senior/disabled property tax freeze favored wealthy. (Feb 2019)

- Raise the top marginal tax rate; negotiate the numbers. (Jan 2019)

- Top earners, corporations should pay "fair share". (Jan 2019)

- Stop taking from middle class & favoring the rich. (Sep 2012)

|

Bill de Blasio on Tax Reform

Bill de Blasio on Tax Reform

|

| NYC Mayor; Democratic Presidential Challenger (withdrawn) |

Click here for 4 full quotes by Bill de Blasio

OR click here for Bill de Blasio on other issues.

- Tax the hell out of the wealthy. (Jul 2019)

- Favors tax increases on wealthy. (May 2019)

- OpEd: NYC property taxes favors the wealthy. (May 2019)

- Fight the agenda of Trump tax giveaway to the wealthy. (Jan 2019)

|

Kirsten Gillibrand on Tax Reform

Kirsten Gillibrand on Tax Reform

|

| Democratic Senator (NY); Democratic Candidate for President (withdrawn) |

Click here for 5 full quotes by Kirsten Gillibrand

OR click here for Kirsten Gillibrand on other issues.

- Extend Bush-era tax cuts, except earners over $250K. (Oct 2010)

- Voted YES on extending AMT exemptions to avoid hitting middle-income. (Jun 2008)

- Voted YES on paying for AMT relief by closing offshore business loopholes. (Dec 2007)

- 50-25-25 budget formula for debt-tax cuts-spending. (Feb 2001)

- Supports more federal taxes & keeping marriage penalty. (Aug 2010)

|

Mike Gravel on Tax Reform

Mike Gravel on Tax Reform

|

| Libertarian for President; Former Dem. Senator (AK); withdrew from Presidential primary July 2019 |

Click here for 11 full quotes by Mike Gravel

OR click here for Mike Gravel on other issues.

- Automatic return-free tax system by online IRS filing option. (Apr 2019)

- Progressive tax: 60% at $1 million, and up from there. (Apr 2019)

- Eliminate income tax so the wealthy canít ďgameĒ the system. (Nov 2007)

- I advocate a FairTax: pay as you spend. (Aug 2007)

- Tax code is corrupt & serves the wealthy. (Jun 2007)

- Wipe out the income tax! -- itís regressive. (Feb 2007)

- National sales tax; no exceptions; prebates for essentials. (Feb 2007)

- Supports a national sales tax to replace IRS. (Jan 2007)

- Repeal the income tax and close down the IRS. (Dec 2006)

- Tax system unfairness only superceded by incomprehensibility. (Apr 2006)

- Less regressive tax on poor; more capital gains on rich. (Jan 1972)

|

Kamala Harris on Tax Reform

Kamala Harris on Tax Reform

|

| Democratic candidate for President (withdrawn); California Senator |

Click here for 10 full quotes by Kamala Harris

OR click here for Kamala Harris on other issues.

- We won't raise taxes on anyone earning less than $400,000. (Oct 2020)

- Americans deserve transparency on president's taxes. (Oct 2020)

- Higher tax on wealthy to fund Medicare-for-All & teacher pay. (Nov 2019)

- Tax credits for middle class & working families. (May 2019)

- Tax relief for middle class; repeal 2017 tax cuts. (May 2019)

- Tax break for people unable to pay unexpected expense. (May 2019)

- Monthly tax credit would provide base income. (Apr 2019)

- LIFT Act: $500 monthly tax credit for eligible middle class. (Jan 2019)

- Payments to needy, not tax breaks for the rich. (Oct 2018)

- Expand EITC, Child Tax Credit, and R&D Tax Credit. (Aug 2016)

|

Howie Hawkins on Tax Reform

Howie Hawkins on Tax Reform

|

| Green Party Challenger for President |

Click here for 5 full quotes by Howie Hawkins

OR click here for Howie Hawkins on other issues.

- Better to tax the rich than borrow and pay interest to them. (May 2019)

- Graduated wealth tax & graduated estate tax. (May 2019)

- Local property taxes upstate are the highest in the nation. (Aug 2018)

- Simple, steeply progressive wealth & income taxes. (Nov 2006)

- Shift to progressively-graduated income and wealth taxes. (Jun 2006)

|

John Hickenlooper on Tax Reform

John Hickenlooper on Tax Reform

|

| Democratic Presidential Challenger (withdrew, Aug. 2019); CO Governor |

Click here for 5 full quotes by John Hickenlooper

OR click here for John Hickenlooper on other issues.

- Don't pass on $1.5 trillion new debt to future generations. (Oct 2020)

- Higher taxes on the wealthy; lower taxes on working families. (Aug 2019)

- Mom-and-pop tax credit for five or fewer full-time employees. (Aug 2019)

- $5 trillion of tax cuts to the wealthy is not the answer. (Oct 2012)

- Undo tax cuts, according to CC survey. (Sep 2020)

|

Jo Jorgensen on Tax Reform

Jo Jorgensen on Tax Reform

|

Click here for 3 full quotes by Jo Jorgensen

OR click here for Jo Jorgensen on other issues.

- Lower or eliminate businesses taxes; end Federal income tax. (Aug 2020)

- Slash spending; shrink government; keep what you earn. (Jul 2020)

- Against a wealth tax; income inequality comes from choices. (Jun 2020)

|

John Kasich on Tax Reform

John Kasich on Tax Reform

|

| Republican Governor; previously Representative (OH-12); 2000 & 2016 candidate for President |

Click here for 15 full quotes by John Kasich

OR click here for John Kasich on other issues.

- Reduce tax withholding by 3.1%. (Aug 2018)

- My plan is no fantasy; I moved Ohio from $8B to $2B surplus. (Oct 2015)

- No taxes on small business; kill the death tax. (Oct 2015)

- Eliminated the Ohio estate tax but hiked cigarette taxes. (Mar 2015)

- $3 billion in tax cuts for job creators. (Feb 2015)

- Lower taxes to create competitive climate. (Nov 2010)

- 1970s: In Ohio Senate, unwilling to raise taxes. (May 2006)

- 10% tax cut to promote charitable giving. (May 1999)

- Tax credits (100%) for charitable donations. (May 1999)

- $776B tax cut plan helps people afford health care. (Mar 1999)

- Voted YES on eliminating the "marriage penalty". (Jul 2000)

- Voted YES on $46 billion in tax cuts for small business. (Mar 2000)

- Opposes both marriage penalty & federal tax increases. (Aug 2010)

- Supports the Taxpayer Protection Pledge. (Jan 2012)

- Repeal marriage tax; cut middle class taxes. (Sep 1994)

|

Amy Klobuchar on Tax Reform

Amy Klobuchar on Tax Reform

|

| DFL Sr Senator (MN); Democratic presidential contender |

Click here for 14 full quotes by Amy Klobuchar

OR click here for Amy Klobuchar on other issues.

- Return to 39.6% top rate; open to wealth tax. (Nov 2019)

- Repeal significant portions of Trump tax bill. (Oct 2019)

- Changes in corporate tax would fund infrastructure. (Mar 2019)

- Extend Bush tax cuts except for those earning over $250K. (Oct 2012)

- Roll back tax cuts on people making over $336,000 a year. (Oct 2006)

- Reduce $250B deficit by rolling back capital gains & top 1%. (Oct 2006)

- Middle class tax cuts good; but current cuts are for rich. (Jan 2006)

- Voted YES on increasing tax rate for people earning over $1 million. (Mar 2008)

- Voted NO on allowing AMT reduction without budget offset. (Mar 2008)

- Voted NO on raising the Death Tax exemption to $5M from $1M. (Feb 2008)

- Voted NO on repealing the Alternative Minimum Tax. (Mar 2007)

- Voted NO on raising estate tax exemption to $5 million. (Mar 2007)

- CC:Reverse federal income tax cuts. (Jul 2018)

- CC:Keep the inhertiance tax. (Jul 2018)

|

Beto O`Rourke on Tax Reform

Beto O`Rourke on Tax Reform

|

| Democratic candidate for President; Texas Senator nominee |

Click here for 9 full quotes by Beto O`Rourke

OR click here for Beto O`Rourke on other issues.

- Tax capital at same rate as regular income. (Jun 2019)

- War tax on non-military households to support vet healthcare. (Jun 2019)

- Voted for oil tax; opposed 2017 tax legislation. (Apr 2019)

- Wealth tax would generate revenue for 'common benefit'. (Mar 2019)

- Everyone should sacrifice, with higher top marginal tax rate. (Mar 2019)

- GOP tax plan helps rich & hurts middle class. (Nov 2017)

- Rated Raising estate tax to 1990s level means $448B in new revenue. (Apr 2015)

- CC:Reverse federal income tax cuts. (Jul 2018)

- CC:Keep the inhertiance tax. (Jul 2018)

|

Barack Obama on Tax Reform

Barack Obama on Tax Reform

|

| Democratic President (2009-2017); IL Senator (2004-2008) |

Click here for 47 full quotes by Barack Obama

OR click here for 11 older headlines

OR click here for Barack Obama on other issues.

- Tax cuts won't help us compete with China; invest instead. (Oct 2012)

- I've cut taxes for middle-class families & small businesses. (Oct 2012)

- We need a tax code where everybody pays their fair share. (Sep 2011)

- We cut taxes 25 times, for 95% of Americans. (Jan 2010)

- FactCheck: Tax cut only helps 75% or workers, not 95%. (Feb 2009)

- Yes, earmarks are abused, but small compared to tax cuts. (Sep 2008)

- Trickle-down economics has failed. (Aug 2008)

- Adjust capital gains tax up to where Reagan set it. (Aug 2008)

- Tax cut for middle class and relief to struggling homeowners. (Jul 2008)

- Expand the Earned Income Tax Credit. (Jul 2008)

- Maintain the inheritance tax on wealthy. (Jul 2008)

- Middle class tax cut helps offset rising cost of gas & food. (Jun 2008)

- Under Bill Clinton, rich people didnít feel oppressed. (Apr 2008)

- Stimulus package: $500 tax cut, & Social Security supplement. (Jan 2008)

- Restore progressive tax; close loopholes; relief to seniors. (Oct 2007)

- Tax incentives to create jobs at home instead of offshore. (Jun 2004)

- Last thing we need now is a permanent tax cut. (Jan 2008)

Taxing the Wealthy

- Bring back the Clinton tax rate for income above $250,000. (Oct 2012)

- It's unfair for a nurse to pay a higher tax rate than Romney. (Oct 2012)

- 47% who don't pay income tax pay many other taxes. (Sep 2012)

- No tax breaks for millionaires; GOP always wants tax cuts. (Sep 2012)

- Buffett rule: millionaires pay minimum of 30% in taxes. (Jan 2012)

- No across-the-board tax cuts for the wealthy. (Jan 2010)

- Tax cuts for wealthy got us into the current deficit. (Jan 2010)

- No $300 billion on tax cuts for those who donít need them. (Sep 2008)

- Tax cut for 95% of all working families, not corporations. (Aug 2008)

- I will raise CEO taxes, no doubt about it. (May 2008)

- No tax increase if earning under $250K; tax cuts under $75K. (Apr 2008)

- Raise capital gains tax for fairness, not for revenue. (Apr 2008)

- Iím not bashful about it: wealthy will pay more taxes. (Jan 2008)

- Trillion dollar giveaway: the Paris Hilton Tax Break. (Oct 2007)

- Reduce Bush tax cuts to pay for health care & other programs. (Jun 2007)

- Estate tax only affects the wealthiest 1/2 of 1%. (Oct 2006)

- Bush tax cuts help corporations but not middle class. (Jun 2004)

Voting Record

- FactCheck: Voted for non-binding tax increase on $42K income. (Sep 2008)

- GovWatch: didnít vote to raise taxes 94 times; at most 54. (Jul 2008)

- Voted YES on increasing tax rate for people earning over $1 million. (Mar 2008)

- Voted NO on allowing AMT reduction without budget offset. (Mar 2008)

- Voted NO on raising the Death Tax exemption to $5M from $1M. (Feb 2008)

- Voted NO on repealing the Alternative Minimum Tax. (Mar 2007)

- Voted NO on raising estate tax exemption to $5 million. (Mar 2007)

- Voted NO on supporting permanence of estate tax cuts. (Aug 2006)

- Voted NO on permanently repealing the `death tax`. (Jun 2006)

- Voted YES on $47B for military by repealing capital gains tax cut. (Feb 2006)

- Voted NO on retaining reduced taxes on capital gains & dividends. (Feb 2006)

- Voted NO on extending the tax cuts on capital gains and dividends. (Nov 2005)

- Rated 100% by the CTJ, indicating support of progressive taxation. (Dec 2006)

|

Mike Pence on Tax Reform

Mike Pence on Tax Reform

|

| Republian nominee for Vice President; Governor of Indiana; former Representative (IN-6) |

Click here for 25 full quotes by Mike Pence

OR click here for Mike Pence on other issues.

- Trump tax cuts give $2,000 to average family. (Oct 2020)

- Capital gains tax cut increases revenue & creates jobs. (Sep 2020)

- Something terribly wrong with taxing dead people. (Sep 2020)

- Lower taxes across the board, and we'll get growth. (Oct 2016)

- Simplify the tax code. (Jan 2015)

- Across-the-board tax relief better than stimulus bill. (Jan 2010)

- Voted NO on extending AMT exemptions to avoid hitting middle-income. (Jun 2008)

- Voted NO on paying for AMT relief by closing offshore business loopholes. (Dec 2007)

- Voted YES on retaining reduced taxes on capital gains & dividends. (Dec 2005)

- Voted YES on providing tax relief and simplification. (Sep 2004)

- Voted YES on making permanent an increase in the child tax credit. (May 2004)

- Voted YES on permanently eliminating the marriage penalty. (Apr 2004)

- Voted YES on making the Bush tax cuts permanent. (Apr 2002)

- Voted YES on $99 B economic stimulus: capital gains & income tax cuts. (Oct 2001)

- Voted YES on Tax cut package of $958 B over 10 years. (May 2001)

- Voted YES on eliminating the Estate Tax ("death tax"). (Apr 2001)

- Reduce the capital gains tax . (Jan 2001)

- Phaseout the death tax. (Mar 2001)

- Rated 76% by NTU, indicating a "Taxpayer's Friend" on tax votes. (Dec 2003)

- Rated 0% by the CTJ, indicating opposition to progressive taxation. (Dec 2006)

- Replace income tax & employment tax with FairTax. (Jan 2009)

- Taxpayer Protection Pledge: no new taxes. (Aug 2010)

- No European-style VAT (value-added tax). (May 2010)

- Replace income tax & estate tax with 23% sales tax. (Jan 2011)

- Supports the Taxpayer Protection Pledge. (Jan 2012)

|

Bernie Sanders on Tax Reform

Bernie Sanders on Tax Reform

|

| Democratic primary challenger; Independent VT Senator; previously Representative (VT-At-Large) |

Click here for 48 full quotes by Bernie Sanders

OR click here for Bernie Sanders on other issues.

- Medicare-for-All raises taxes on middle class, but net gain. (Jun 2019)

- Supports progressive taxation; closing loopholes for wealthy. (Apr 2019)

- Replace carried-interest loophole with progressive taxation. (Aug 2017)

- Raise funds in a progressive way, for ObamaCare & everything. (Feb 2017)

- 1980s: progressive property tax, plus Meals & Rooms tax. (Nov 2016)

- Tax code is rigged to favor top 2% of billionaires. (Nov 2016)

- We need a progressive tax system based on ability to pay. (Mar 2015)

- Filibustered against Obama-Republican tax deal. (Dec 2010)

- Cap the home mortgage interest deduction at $300,000. (Jun 1997)

- Property taxes are highly regressive & hurt poor & seniors. (Jun 1997)

- 1% room-and-meal tax instead of property tax. (Jun 1997)

- Tax increases may affect more than top 1%. (Oct 2015)

Progressive Taxation

- Wealth tax of 8% on fortunes over $10 billion. (Nov 2019)

- Top rate of 77% for estates over $1 billion. (Apr 2019)

- 1974: 100% tax over $1 million. (Mar 2019)

- Close loopholes that let wealthy avoid taxes. (Feb 2019)

- Raise income tax & fix estate tax: hardly Marxist ideas. (Feb 2019)

- 0.1% tax on Wall Street speculation. (Nov 2016)

- End loophole that allows zero taxes via Cayman Islands. (Feb 2016)

- Wealthiest will pay more but not as much as under Eisenhower. (Nov 2015)

- Increase tax on wealthy; close loopholes for corporations. (Sep 2015)

- Raise top marginal income tax rate from 39% to over 50%. (Sep 2015)

- Increase estate tax rates on inheritances over $3.5M. (Jun 2015)

- Double the capital gains tax for the wealthiest 2%. (Apr 2015)

- Real tax reform based on ability to pay. (Jan 2015)

- Capital gains & dividend tax cuts are giveaways to the rich. (Jun 2006)

Voting Record

- Lower cutoff for estate tax from $5.4M to $3.5M. (Sep 2015)

- Voted YES on increasing tax rate for people earning over $1 million. (Mar 2008)

- Voted NO on allowing AMT reduction without budget offset. (Mar 2008)

- Voted NO on raising the Death Tax exemption to $5M from $1M. (Feb 2008)

- Voted NO on repealing the Alternative Minimum Tax. (Mar 2007)

- Voted NO on raising estate tax exemption to $5 million. (Mar 2007)

- Voted NO on retaining reduced taxes on capital gains & dividends. (Dec 2005)

- Voted YES on providing tax relief and simplification. (Sep 2004)

- Voted NO on making permanent an increase in the child tax credit. (May 2004)

- Voted YES on permanently eliminating the marriage penalty. (Apr 2004)

- Voted NO on making the Bush tax cuts permanent. (Apr 2002)

- Voted NO on $99 B economic stimulus: capital gains & income tax cuts. (Oct 2001)

- Voted NO on Tax cut package of $958 B over 10 years. (May 2001)

- Voted NO on eliminating the Estate Tax ("death tax"). (Apr 2001)

- Voted NO on eliminating the "marriage penalty". (Jul 2000)

- Voted NO on $46 billion in tax cuts for small business. (Mar 2000)

- American People's Dividend: Give $300 to every person. (Feb 2001)

- Rated 28% by NTU, indicating a "Big Spender" on tax votes. (Dec 2003)

- Rated 100% by the CTJ, indicating support of progressive taxation. (Dec 2006)

- Minimum tax rate of 30% for those earning over $1 million. (Mar 2012)

- CC:Reverse federal income tax cuts. (Jul 2018)

- CC:Keep the inhertiance tax. (Jul 2018)

|

Mark Sanford on Tax Reform

Mark Sanford on Tax Reform

|

| Republican SC Governor; previously Representative (SC-1); GOP Presidential Challenger (withdrawn) |

Click here for 8 full quotes by Mark Sanford

OR click here for Mark Sanford on other issues.

- Voted YES on eliminating the "marriage penalty". (Jul 2000)

- Voted YES on $46 billion in tax cuts for small business. (Mar 2000)

- Adopt a single-rate tax system. (Jul 2010)

- Repeal tax hikes in capital gains and death tax. (Jul 2010)

- Replace income tax & estate tax with 23% sales tax. (Jan 2011)

- Replace income tax and IRS with FairTax. (Jan 2015)

- Death Tax is a pernicious double tax. (Apr 2015)

- Repeal marriage tax; cut middle class taxes. (Sep 1994)

|

Howard Schultz on Tax Reform

Howard Schultz on Tax Reform

|

| Starbucks CEO; independent candidate for President until July 2019 |

Click here for 3 full quotes by Howard Schultz

OR click here for Howard Schultz on other issues.

- Would increase taxes on rich, sketchy on details. (Mar 2019)

- Tax cuts for the middle class; but wealthy pay more. (Feb 2019)

- Took $150M stock options to save Starbucks $82M in taxes. (May 2016)

|

Tom Steyer on Tax Reform

Tom Steyer on Tax Reform

|

| Democratic Presidential Challenger; CEO |

Click here for 12 full quotes by Tom Steyer

OR click here for Tom Steyer on other issues.

- Unbearable inequality in most unfair tax regime I've seen. (Feb 2020)

- Cut taxes for 95% of Americans by 10%. (Dec 2019)

- Supports higher estate tax, annual wealth tax. (Nov 2019)

- Repeal Trump tax cuts; close corporate tax loopholes. (Nov 2019)

- Boost taxes 1% on wealthiest 0.1% of Americans. (Jul 2019)

- Upper income people have done disproportionally well. (Jul 2019)

- Upper-income people have done "disproportionately well". (Jul 2019)

- Oppose legislative supermajority for raising fees & levies. (Jul 2019)

- Tax surcharge on personal incomes over $250,000. (Jul 2019)

- Tax reform bill keeps the rich happy but hurts middle class. (Oct 2017)

- Implement 1 percent annual wealth tax on America's richest. (Oct 2016)

- OpEd: Steyer's tax proposal would hit poor hardest. (May 2015)

|

Donald Trump on Tax Reform

Donald Trump on Tax Reform

|

| 2016 Republican incumbent President; 2000 Reform Primary Challenger for President |

Click here for 42 full quotes by Donald Trump

OR click here for Donald Trump on other issues.

- Republicans shouldn't raise taxes for infrastructure deal. (Jul 2021)

- Cutting taxes & boosting economy most important to people. (Oct 2020)

- Fact Check: Claims falsely that Biden would raise all taxes. (Sep 2020)

- People want tax cuts; don't understand tax reform. (Feb 2018)

- Doubled standard deduction for all; average $2000 tax cut. (Jan 2018)

- 1991: Reagan tax cut a catastrophe; 2017: Reagan led economy. (Aug 2017)

- OpEd: 1986 tax reform was revenue-neutral; 2017 reform isn't. (Aug 2017)

- Cutting corporate taxes will be a great job creator. (Apr 2017)

- FactCheck: Cutting carried interest gains $18B in revenue. (Oct 2016)

- Get rid of carried interest and cut taxes big league. (Oct 2016)

- I'm gonna cut taxes and regulations big league. (Sep 2016)

- Tax cuts for the wealthy, who will create tremendous jobs. (Sep 2016)

- Cut taxes by $10T but don't increase deficit. (Oct 2015)

- 1998: I'd like to see major tax cuts, 800 billion or more. (Oct 2015)

- Estate tax is unfair double taxation. (Oct 2015)

- Do away with carried interest; it's unfair. (Oct 2015)

- OpEd AdWatch: Trump more liberal on taxes than Democrats. (Sep 2015)

- Raise graduated taxes on hedge fund managers. (Sep 2015)

- 4 brackets; 1-5-10-15%; kill death tax & corporate tax. (Dec 2011)

- Cutting tax rates incentivizes a strong national work ethic. (Dec 2011)

- Simplify tax code; end marriage penalty & other hidden taxes. (Jul 2000)

- 1986 tax laws destroyed incentives retroactively. (Oct 1997)

- High tax rate encourages investment risk. (Oct 1997)

Personal Finances

- I am under-leveraged, despite $421 million in debt. (Oct 2020)

- I pay millions of dollars in income taxes, not $750. (Sep 2020)

- FactCheck: claimed "killed" by tax bill, but gained millions. (Jun 2019)

- OpEd: Can't release tax returns while under audit? Nixon did. (Oct 2016)

- Personally avoids sales tax, but knows many people like it. (Dec 1999)

Wealth Tax

- FactCheck: False claim that Biden raises everybody's taxes. (Sep 2020)

- Comparison of Warren wealth tax to Trump wealth tax. (Jan 2019)

- Repeal estate tax; it's double taxation. (Oct 2015)

- FactCheck: Proposed 14% tax on wealthy in 2000, but not now. (Sep 2015)

- No net increase in taxes, but increases on wealthy. (Sep 2015)

- OpEd: One-time wealth tax could cause stock market collapse. (Sep 2015)

- One-time 14% tax on wealthy to pay down national debt. (Jun 2015)

- Previously supported wealth tax; now supports Bush tax cuts. (Apr 2011)

- Repeal the inheritance tax to offset one-time wealth tax. (Jul 2000)

- Opposes flat tax; benefits wealthy too much. (Jul 2000)

- One-time 14.25% tax on wealth, to erase national debt. (Nov 1999)

- Tax assets over $10 million, paid over 10 years. (Nov 1999)

- Opposes increasing income tax rates. (Nov 2016)

- Supports eliminating the death tax. (Nov 2016)

|

Jesse Ventura on Tax Reform

Jesse Ventura on Tax Reform

|

| Former Independent MN Governor; possible Presidential Challenger |

Click here for 22 full quotes by Jesse Ventura

OR click here for Jesse Ventura on other issues.

- OpEd: Reduction of deficit were "Jesse taxes". (May 2010)

- Cut fees on only some watercraft, as unconstitutional. (Apr 2008)

- Remove "license tab fees": a hidden sales tax. (Apr 2008)

- Base property tax on services needed, not on value of home. (Apr 2008)

- Replace property-tax-funded schooling with general funds. (Apr 2008)

- Need balance between tax relief, services expected. (Jan 2002)

- Tax increases may be necessary, but use every dollar well. (Jan 2002)

- Supported Bush tax cuts; it was over-taxation money. (Mar 2001)

- Property tax needs to be smaller, simpler, fairer. (Jan 2001)

- Across the board reduction in state income tax rates. (Jan 2001)

- Find a way for state taxes to be collected on ecommerce. (Jan 2001)

- Modernize, simplify, & clarify tax system. (Dec 2000)

- Repeal the 16th Amendment. (Jul 2000)

- Replace income with national sales tax. (Jul 2000)

- Reforming property tax system a high priority. (Mar 1999)

- Let people keep as much of their money as possible. (Jan 1999)

- $600 ďJesse ChecksĒ tax rebate to every taxpayer. (Jan 1999)

- Replace income tax with 15% national sales tax. (Jan 1999)

- Supports national consumption tax to equalize tax burden. (Nov 1998)

- Reform outdated property tax system. (Oct 1998)

- No national sales tax or VAT. (Feb 2000)

- Let states independently determine estate taxes. (May 2001)

|

Arvin Vohra on Tax Reform

Arvin Vohra on Tax Reform

|

| Libertarian candidate for President; Libertarian Party Vice-Chair |

Click here for 2 full quotes by Arvin Vohra

OR click here for Arvin Vohra on other issues.

- End welfare & other programs, and then abolish income tax. (Mar 2018)

- UK should cut taxes and cut regulations. (Jun 2016)

|

Joe Walsh on Tax Reform

Joe Walsh on Tax Reform

|

| Republican presidential primary challenger (former IL Rep.) |

Click here for 6 full quotes by Joe Walsh

OR click here for Joe Walsh on other issues.

- Focus tax cuts on middle class and payroll tax. (Sep 2019)

- Reduced tax rates will increase economic activity. (Feb 2010)

- Taxpayer Protection Pledge: no new taxes. (Aug 2010)

- Adopt a single-rate tax system. (Jul 2010)

- Repeal tax hikes in capital gains and death tax. (Jul 2010)

- Supports the Taxpayer Protection Pledge. (Jan 2012)

|

Elizabeth Warren on Tax Reform

Elizabeth Warren on Tax Reform

|

| Massachusetts Senator; former head of CFPB; Dem. Presidential Challenger |

Click here for 20 full quotes by Elizabeth Warren

OR click here for Elizabeth Warren on other issues.

- The wealthy have rigged the tax code: tons of loopholes. (May 2021)

- The wealthy have rigged the tax code, tons of loopholes. (May 2021)

- FactCheck: "2% wealth tax" is 6% on wealthiest billionaires. (Feb 2020)

- Your first $50M is free and clear under my wealth tax. (Nov 2019)

- Increase taxes on millionaires & billionaires. (May 2019)

- Proposes wealth tax for fortunes over $50 million. (Apr 2019)

- Large firms should pay 7% tax on profits over $100 million. (Apr 2019)

- Businesses should recognize how US helped them succeed. (Mar 2019)

- Comparison of Trump wealth tax to Warren wealth tax. (Jan 2019)

- 2% wealth tax on assets over $50M; 3% over $1B. (Jan 2019)

- Wealth tax: $4.1 billion per year on fortune of $137 billion. (Jan 2019)

- Curb inequality: 2% tax on assets over $50M; 3% over $1B. (Jan 2019)

- Making housing affordable by raising estate tax. (Sep 2018)

- Reagan tax cuts reduces revenue and increase national debt. (Apr 2017)

- Demand the wealthy pay their fair share of taxes. (Apr 2017)

- Lots of wealth in America but it stays at the top. (Jul 2016)

- Who pays? Everyone, or just the little guys? (Apr 2014)

- Stop protecting loopholes for millionaires. (Sep 2012)

- End tax breaks to the already-rich and already-powerful. (Jan 2012)

- Supports increasing tax rates. (Oct 2012)

|

Bill Weld on Tax Reform

Bill Weld on Tax Reform

|

| Libertarian Party nominee for Vice Pres.; former GOP MA Governor; 2020 GOP Presidential Challenger |

Click here for 9 full quotes by Bill Weld

OR click here for Bill Weld on other issues.

- I never met a tax cut I didn't like. (Sep 2019)

- Favors cutting spending, cutting taxes. (Apr 2019)

- Cut capital gains tax; look at flat tax on income. (Feb 2019)

- I am releasing my returns and Trump should release his. (Oct 2016)

- Cut taxes without abolishing the IRS. (Jun 2016)

- 1990s: Produced nine tax cuts as governor of Tax-achussets. (Nov 2005)

- Cut taxes 15 times as governor. (Oct 1996)

- My across-the-board tax cuts exceeded $1 billion. (Oct 1996)

- Roll back more than $2 billion in recent tax increases. (Jan 1996)

|

Andrew Yang on Tax Reform

Andrew Yang on Tax Reform

|

| Democratic Presidential Challenger & Tech CEO |

Click here for 9 full quotes by Andrew Yang

OR click here for Andrew Yang on other issues.

- Push NYS for a Vacancy Tax on empty storefronts. (Mar 2021)

- End Social Security cap, favorable capital gains treatment. (Nov 2019)

- Wealth tax didn't work where it was tried. (Oct 2019)

- Value-added tax would generate $800B taxes & $700B GDP. (Jun 2019)

- Fund programs from tech companies now paying no tax. (Apr 2019)

- Value Added Tax would generate $800 billion. (Apr 2019)

- Institute 10% VAT, like 160 other countries. (Apr 2019)

- Revenue Day: make paying taxes a celebration. (Mar 2019)

- Value-Added Tax as part of new capitalist philosophy. (Feb 2019)

|

|

|